Hans-Joachim Hebgen, an experienced financing expert, provides advisory services on behalf of the Agency for Business and Economic Development (AWE) to companies that want to finance investments in a developing country or emerging economy. In this interview, he explains what is important in financing and project planning and how companies can find the right funding programme for their needs.

Investments must be cost-effective and achieve development results

AWE: Mr Hebgen, what ideas and projects do companies bring with them when they come to you for advice?

Hebgen: Companies contact us because they want to tap into new markets in developing countries, secure their supply chains and supply of raw materials or benefit from cost advantages by producing in the Global South. Their projects focus on sectors including green tech, renewable energy, agriculture and food, health and the manufacturing industry. Start-ups and private individuals approach us because they want to develop new ideas and business models in the Global South. And then we have companies who have already set up production sites in a developing country and are now planning to expand. There are also projects that involve training skilled workers in partner countries or training supplier companies. The requirements for support or financing are therefore very varied.

Business plan as a basis

AWE: What kind of support can these companies expect from financing partners and funding projects in development cooperation?

Hebgen: It’s important to realise that in order to apply for funding or financing for investments in developing countries, you need a well thought out strategy – just as you do for other financing partners if you want to convince them. What is the project goal? How can I ensure that the project will be successful in the long term – even after public funding has been phased out? What financial and human resources will I be contributing myself in order to achieve the goal? What are the country and project risks? What partners do I have and need in the partner country?

AWE: So companies and investors need a conventional business plan for their projects in developing countries?

Hebgen: Basically yes. They need a business plan for their own investment planning and they need to convince donors that their project is meaningful and sustainable. In times of tighter public budgets for development cooperation, the bar is being raised all the time. Companies should be prepared for their project to undergo a systematic and thorough examination. And that’s how it should be, because after all, investments paid for using tax revenue need to be profitable on a lasting basis for everyone involved. We want to avoid deadweight effects and the projects must have a pro-development impact. Properly financed, well thought out projects are usually successful. I always advise people to prepare a presentation of about five pages that answers the following questions in particular: What kind of company are we? What is my project designed to achieve? What measures do I intend to use to achieve the project goal? How large is the project volume? How will it be financed? And what development impact will the project have? This information helps us identify the right financing partners and programmes.

Funding and financing offers

AWE: What programmes do you think are particularly attractive?

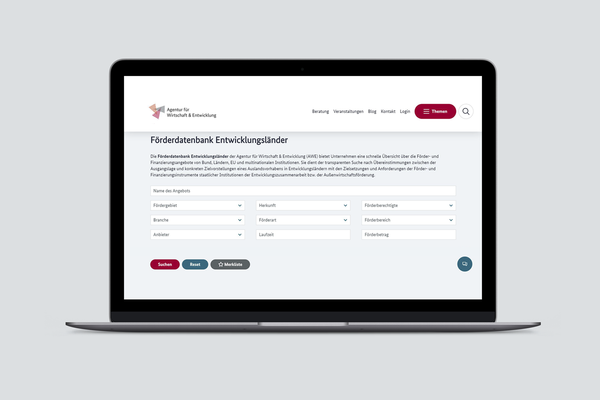

Hebgen: There is no single answer to that. It’s important to note that there are around 120 different funding programmes from Germany, the EU and international donors in the AWE funding and financing database alone. Each individual case needs to be examined to see what would suit the needs of the particular company and project. For example, there are a large number of exciting programmes for particular sectors or countries, such as the Hospital Partnerships initiative launched by the German Federal Ministry for Economic Cooperation and Development (BMZ) and the market development programme by the German Federal Ministry for Economic Affairs and Energy (BMWE).

AWE: What role does the size of the company play when choosing the financing partners?

Hebgen: There are funding and financing programmes for different company sizes. A very successful one in high demand is the develoPPP programme launched by BMZ, under which grants of up to EUR 2 million are provided. That’s an interesting programme for small and medium-sized enterprises (SMEs) in particular. For larger SMEs, the ImpactConnect programme can be a good fit. Companies can apply for loans of up to EUR 10 million under the programme. And then for large-scale projects, there are financing opportunities from development banks such as DEG and KfW IPEX Bank.

Financing options for start-ups

AWE: And what about programmes for start-ups and entrepreneurs?

Hebgen: Many of the conventional financing programmes are not particularly suitable for start-ups, because companies usually need to submit balance sheets from the previous two years to apply for funding. There also needs to be a proof of concept and of course enough staff too. That’s important because we want the projects to be sustainable and successful for the company, the financing partners and the developing country. A good idea often isn’t enough on its own. For innovative start-ups and committed entrepreneurs, however, it can be worthwhile looking around for venture capital funds in the developing countries themselves. The large international development banks often finance special funds there for smaller-scale projects that contribute to achieving the Sustainable Development Goals. That’s not direct financing; instead, funding is applied for through local banks in the relevant country.

Published on

![[Translate to English:] [Translate to English:] Hans Joachim Hebgen](/fileadmin/_processed_/4/a/csm_Foto_Hebgen_2_5ba0fa7729.jpg)